Services

The Process of Rebuilding your Credit

Repairing credit takes time and there is no quick way to fix a credit score. Quick-fix efforts are likely to backfire, so beware of any advice that claims to improve your credit score fast. The best advice for rebuilding credit is to manage it responsibly over time.

If you follow these important steps you are guaranteed Credit Success

Making your credit payments on time

Pay off debt rather than moving it around

The first thing you should limit is your use of credit cards

Keep balances low on credit cards and other revolving credit

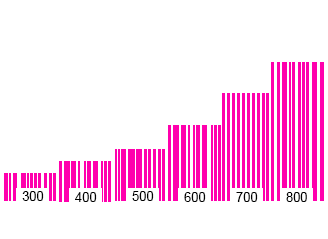

Credit Score Activity

We each have our own unique credit history. Yours may comprise an entire constellation of financial decisions, ranging from the big an auto loan or a mortgage to the small making your credit card’s minimum payment on time.

Whether you have good credit, bad credit or need to build credit from scratch, there is always room for improvement. There’s no fast lane to an excellent credit score, but responsible financial habits can go a long way toward boosting your credit health.

Magnificent$ Financial Services will provide you with real time credit updates with credit monitoring and credit alerts. You will know first had what is impacting your credit score.

Frequently Asked Questions

How long before I see results?

It depends on your situation, goals and how much work is required on our part. My focal point is to attack the most critical areas first, and those that will make the most impact to improving your score. I will work in a timely manner to ensure that your creditors are reporting accurate information.